Lighthouse Bridges the Gap with Asset Management

Are you truly an EXPERIENCED Asset Manager?

Throughout our decades of acquiring , auditing and managing multifamily properties we realized a very significant role was missing from the investment team- THE ASSET MANAGER!

Many people set out on a journey to become an owner or investor in multifamily real estate. They invest their time and financial resources into various education sources and programs which teach them how to "climb the mountain" of identifying emerging markets, building broker relationships, underwriting, networking, raising capital, creating partnerships, understanding debt options, identifying lending solutions, and closing on an property.

With alot of hard work and perserverance, they get to the top of this mountain and become the proud owner of multifamily property!

They are taught to hire a good local property management company, so once they do this, they hand off their asset to their property management team and turn around to focus on their next acquisition adventure.

Many owners have the vision of being able to quit their day job, focus on acquisitions, and live off acquisition fees and cash flow. They do not realize that they just bought a 24 hour/7 day a week operating BUSINESS and who is going to be the CEO of this new business? They just partnered with a property management group that they may have zero experience or relationship with. While they sincerely believe this team will operate their investment successfully to meet their investment goals and represent the culture of the ownership team on site, who will effectively "trust, but verify" this is being done? Who has the EXPERIENCE and knowledge of how to manage the property management team? Who will be the bridge between the Investment Team and the Operational Teams? Many operators fail in the EXECUTION of the business plan- don't let this be you!

Leveraging our relationships and experience, our team adds significant value and helps identify both challenges and opportunities at each stage of a propertys lifecycle, from acquisition through operations, and during the asset disposition we strive to enhance your investment yield and provide superior level of service to you , your partners, investors and most of all our residents.

We create unique asset management plans designed specifically for your investments goals. We have developed a "toolbox" of proven systems and strategies to assist and enhance the performance of our operational partners with executing these plans, all while creating quality communities on purpose for purpose!

We Optimize Your Investment,

And Minimize Your Risk.

Asset Management Services

- NOI performance tracking

- Budget creation & reforecasting

- Capital expenditure planning

- Monthly financial review & variance reporting

- Owner reporting packages

- Rent roll audits

- Collections oversight

- Lender & banking relations

- Cash flow forecasting

- Investor reporting & communication

- Site team performance audits

- Maintenance program evaluation

- Vendor contract review & negotiation

- Utility & expense benchmarking

- Staffing structure recommendations

- Payroll and hours efficiency review

- Lease file audits

- Policy & procedure standardization

- Preventative maintenance planning

- Compliance monitoring (local/state/federal)

- Audit Coordination & Support

- Property Management enhancement options available

- Pricing strategy oversight

- Market survey analysis & rent positioning

- Concession tracking & strategy

- Renewal strategy and performance monitoring

- Leasing script & SOP creation

- Website and listing audits

- Traffic conversion tracking

- Vacancy loss mitigation planning

- Unit mix performance analysis

- Lead management and oversight

- Business plan enforcement

- Hold/sell/refinance analysis

- Equity structuring & investor strategy

- Debt planning and refinancing guidance

- Exit strategy modeling

- Strategic repositioning plans

- Ownership objective alignment

- Real-time decision support during disruptions

- Value-add feasibility and ROI projections

- Deal-level stress testing and scenario planning

- Weekly property managment calls

- Quarterly ownership calls

- Owner, Lender, and Investor reporting

- Site-level leadership syncs

- Property manager coaching

- Interdepartmental coordination (PM, CapEx, etc.)

- Training site teams on ownership goals

- Conflict mediation between site & ownership

- Emergency response oversight

- Policy communication & enforcement

- Vision alignment across the org chart

- “Walk with purpose” property visits with reporting

- Property Management Company Review

- Market Studies

- Due Diligence Support

- Compliance Reviews

- Operating & Capital Budget Support

- Capital Needs Assessment

- Capex Plans

- Financial Audits

- Financing Review

- Investor Relations Support

- Financial Reviews

- Operational Reviews

- Proforma to Actual Reviews

- Meetings with GP Team

- Meetings with Management Companies

- Site Visits

- K-1 Tracking

- Investment Managing

When your VISION is CLEAR, your OPTIONS are FEWER and your DECISIONS become EASIER.

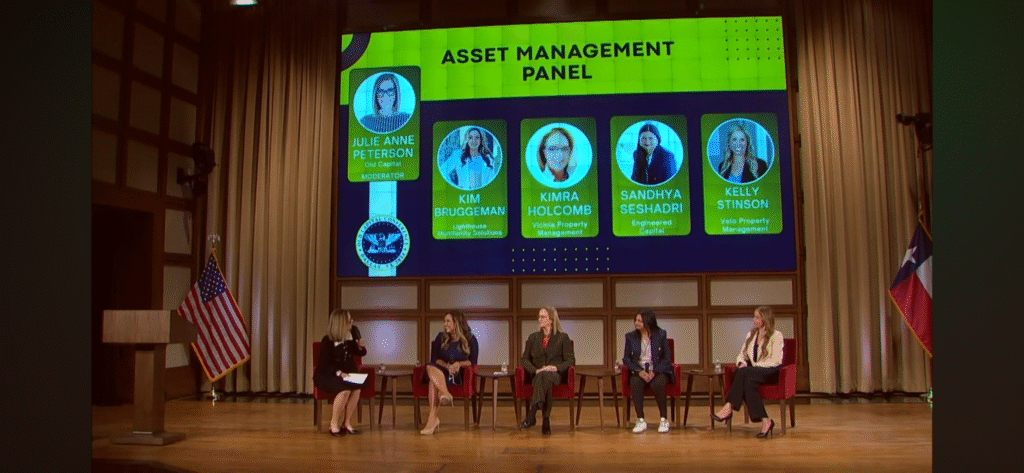

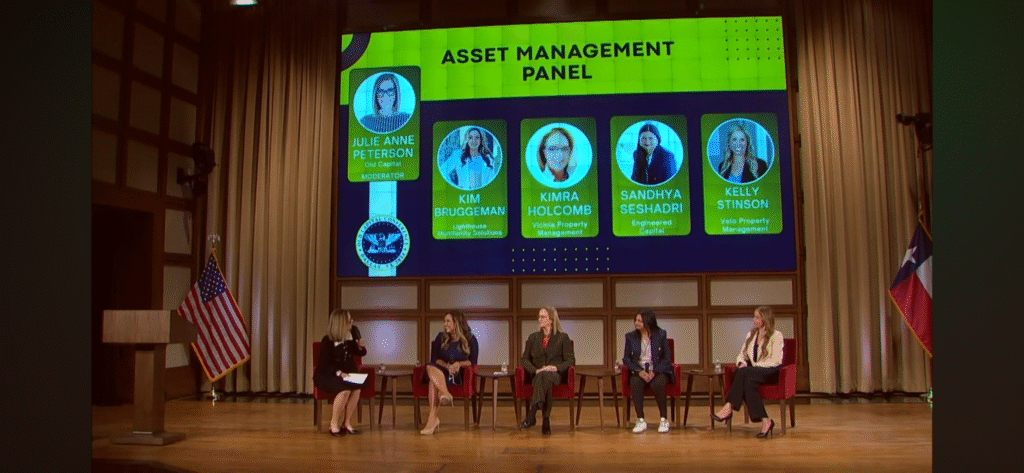

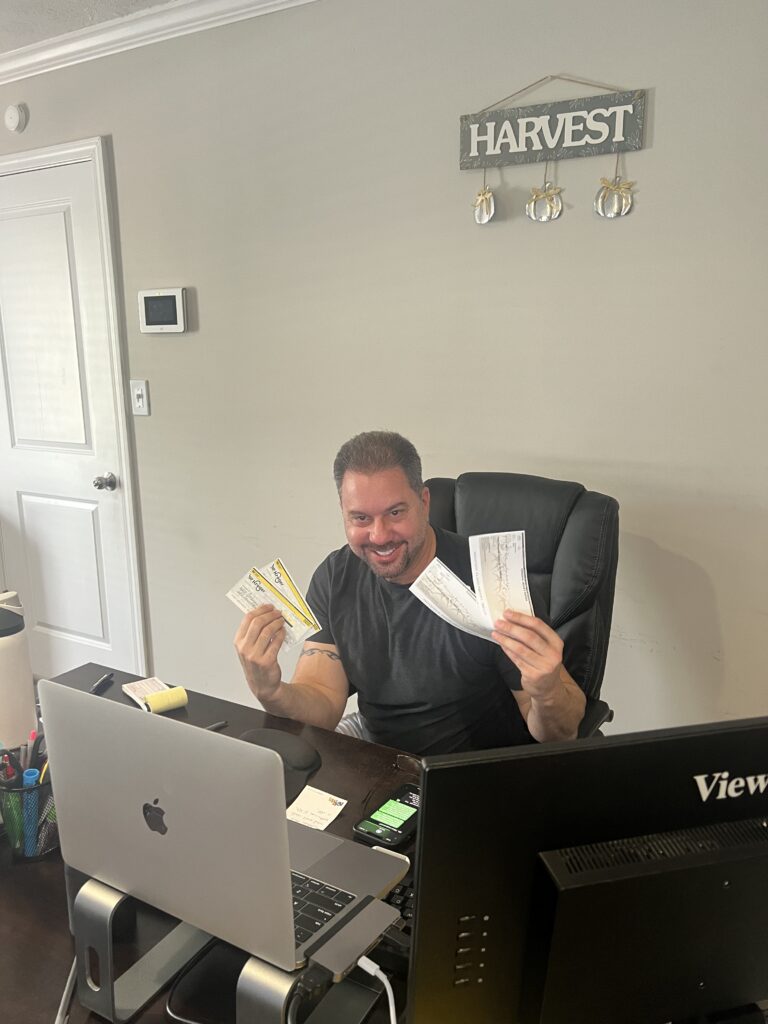

Mr. & Mrs. Asset Manager

In Action

We’ve seen great deals falter under weak oversight, poor management, or short-sighted decisions. We step in with the clarity, discipline, and experience to create Stabilization, Reposition or Disposition Plans for our clients.

For owners and investors facing stalled performance, disappearing distributions, or lack of transparency- Let us help you protect your capital, enforce the plan and maximize long term value.

Let Lighthouse Bridge the Gap between your Investment and Operation Teams

Ask us about our four pillars of Asset Management